(Powerpoint Display: What is it? + picture of common trading scene)

In simple terms, the sharemarket is just like a big supermarket for buying and selling shares in different companies. The main use of the sharemarket is for companies to raise additional funds to finance their debts and projects by issuing shares in their company for people to buy. When a person buys shares in a company, they then become part owner of that company. This means they share in the companies profits and losses. If a company is doing well, their share price would go up, making their shares more valuable. If you have shares in a prospering company, you usually also receive a substantial dividend, which is a share in the companies profits. If you buy shares in a company, and it started losing money, shareholders would soon panic and sell their shares, and the price would go down. You wouldn't receive much of a dividend, if your company was losing money.

Shares are one of the three main investments that most people choose to invest in (the other two being property investments and fixed interest investments).

Today, there are 89 stockbrokers that are currently authorised to buy and sell shares on the Australian sharemarket. Today, all the buying and selling on the sharemarket is conducted on an Australia-wide linked computer system, which means the stockbrokers work from their office.

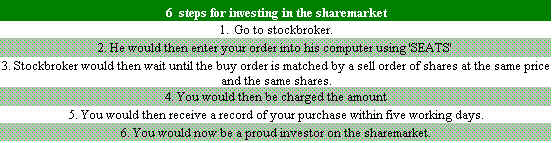

(Powerpoint Display: 6 steps for investing on the market)

By the way, if you were wondering what 'SEATS' stands for, it is: the Stock Exchange Automated Trading System. This is the computer network in which all of the buying and selling is conducted on the Australian Sharemarket.

Shareholders receive on average, a higher return than the people or banks that lend the companies money, because the shareholders have much more at risk. The lenders, in a sense, are almost guaranteed that they will be paid back, while the shareholders have no guarantee that they will make money at all.

People often like to buy shares in well known companies such as Coca-Cola, coles-myer and BHP, because they think they will become part owner of that company. This is of course, in theory true, but any one person's investment is usually too small to be of any significance to the company. Its only big firms and people like Bill Gates that can have a large influence on the sharemarket.

The Australian Sharemarket's performance is measured by the All Ordinaries index. It tracks changes in the total value of some 300 of the major listed Australian companies so that the index represents approximately 80% of the market value of all the listed Australian companies.

The Sharemarket has evolved over 700 years to become one of the most popular means of investment.

(Powerpoint display: Game update)

Greg Cathro / The Australian Sharemarket Explained Simply / pg 1-5