(Powerpoint Display: Title)

The sharemarket isn't simply about buying and selling shares, there are also many other seemingly complicated angles, such as The Options Market and The Futures Market. Many people have a broad knowledge of the Sharemarket and how shares work. There are also a very large amount of people who actually invest on the sharemarket. But when it comes to the Options Market and the Futures Market, a lot of people seem to think they are too complicated. As you will see, this is of course not true.

The companies which are traded on the options market have a large number of shares on issue which are widely held and actively traded.

There are only a selected list of companies which have options on their shares traded, for example, ANZ Bank, CRA Ltd, Coles Myer Ltd.

By the way, we are talking about exchange-traded options, not company options. Company Options are an agreement between the company that issued them and the option holder.

The Options that we are talking about, the exchange-traded options, are an agreement which gives the share holder the right with no obligation to buy or sell specific shares on a certain date at a set price on a specified date. There are two types of these options. A call option and a put option. A call is the option to buy shares at a pre-determined price on a set date. A put is the option to sell shares at a pre-determined price on a set date.

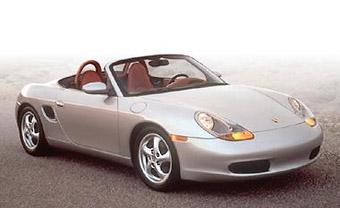

To explain how a call option works, imagine you wanted to buy a Porsche Boxter at a certain time, but you are afraid the prices will rise drastically in the near future.

(Powerpoint Display: Picture of Porsche Boxster)

You negotiate a deal with the salesperson which allows you to buy the car for $95 000 this time next year. The Salesperson would charge you a premium, say $2 500 for your option. If you came back to buy the car next year, and the price of the car had risen to $110 000, you would still be able to buy the car for $97 500 (this includes the premium), and you would have saved yourself $12 500. On the other hand, if the price of the car had dropped to $89 000, you could drop your option, and pay $91 500 for the car including your premium. You would still have saved $3 500 from the amount you were prepared to pay.

The difference with the put option is that you are the seller, not the buyer. Imagine you own a Corvette C5, and you want to sell it next year, and you are afraid its value will drop a lot in one year.

(Powerpoint Display: Picture of Corvette C5)

You could negotiate to buy a put option with a prospective buyer to sell the car for $45000 next year, and you would have to pay a premium, say $1000. Then, next year, when it comes time to sell the car's value has dropped down to $30 000. You would then be able to sell the car for $44 000. You have saved yourself $14 000.

Now you know simply what call and put options are. Now you can convert this basic knowledge to the Options market.

A call option over shares is a contract that gives the buyer the right to buy shares at a predetermined price on or before a specific date. When you use your option, you instruct the person who sold you the option to sell you the shares, which they have to do. It works like this: Say an investor thinks the price of Coles-Myer shares will go up, he could buy a call option over a parcel of 1000 shares. He would pay a $1 premium on each share to secure the price at $8. The option is valid till a set date. The price of the shares would then have to rise to $9 just for him to break even. If the price rose to $13, he would have made $4000 profit.

A put option in shares is when you buy the option to sell your shares at a certain price at or before a predetermined date. People use this option for security if they think their shares may drop in value.

The main point, as you will see, that separates options from futures, is that with options, you have the right, but not the obligation to buy or sell.

Some people that trade on the Options market like to use the hedge sitting strategy. This is when they buy an amount of shares, plus they buy the put option along with that, to protect them in case the price falls.

Also each single options contract is a parcel of 1000 shares.

The year when call options began was 1976, and put options began 7 years later.

(Powerpoint Display: Game update)

Ron Bennetts / The Stockmarket / pg 110-115